RAMEENA JALIL

Product Designer

Fintech · FP&A · Cash Flow · Forecasting · AI

Financial Intelligence & AI-Assisted Decision Platform

Financial Intelligence

& AI-Assisted Decision Platform

Designing a trust‑critical financial intelligence platform that helps finance leaders analyze performance, manage cash flow, and make confident, data‑driven decisions using AI‑assisted insights.

Designing an end‑to‑end job lifecycle for a two‑sided care platform, focusing on trust, accountability, and payments.

Enter password to view case study

Context & Product Reality

Context & Product Reality

Finmetrx was an early‑stage fintech product with strong backend financial logic and AI experimentation, but no cohesive product experience. Core financial calculations, data pipelines, and agent logic existed in isolation, making the system difficult to use, reason about, and scale.

When I joined, the challenge was not designing "another dashboard", but translating raw financial logic, stakeholder knowledge, and technical constraints into a usable, trustworthy product system.

Finmetrx was an early‑stage fintech product with strong backend financial logic and AI experimentation, but no cohesive product experience. Core financial calculations, data pipelines, and agent logic existed in isolation, making the system difficult to use, reason about, and scale.

When I joined, the challenge was not designing "another dashboard", but translating raw financial logic, stakeholder knowledge, and technical constraints into a usable, trustworthy product system.

Key realities

Key realities

Backend logic existed, product experience did not (0->1)

Highly data‑dense, trust‑critical domain

CFO‑level accountability for accuracy and decisions

No prior design system or interaction model

The Core Problem

The Core Problem

Finance teams had access to large volumes of financial data, but lacked a unified system that could:

Connect actuals with forecasts in a meaningful way

Surface cash flow risks early, not reactively

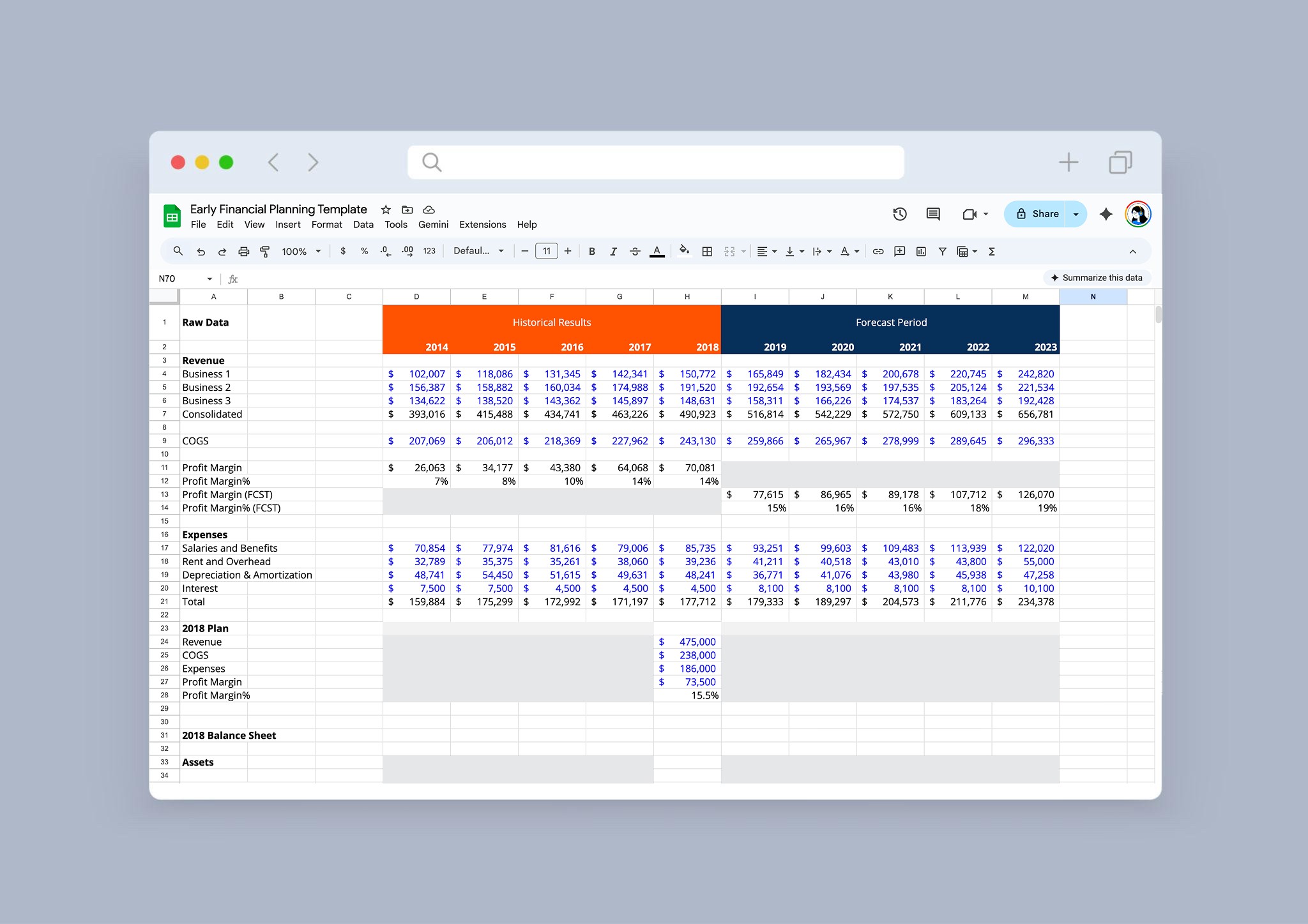

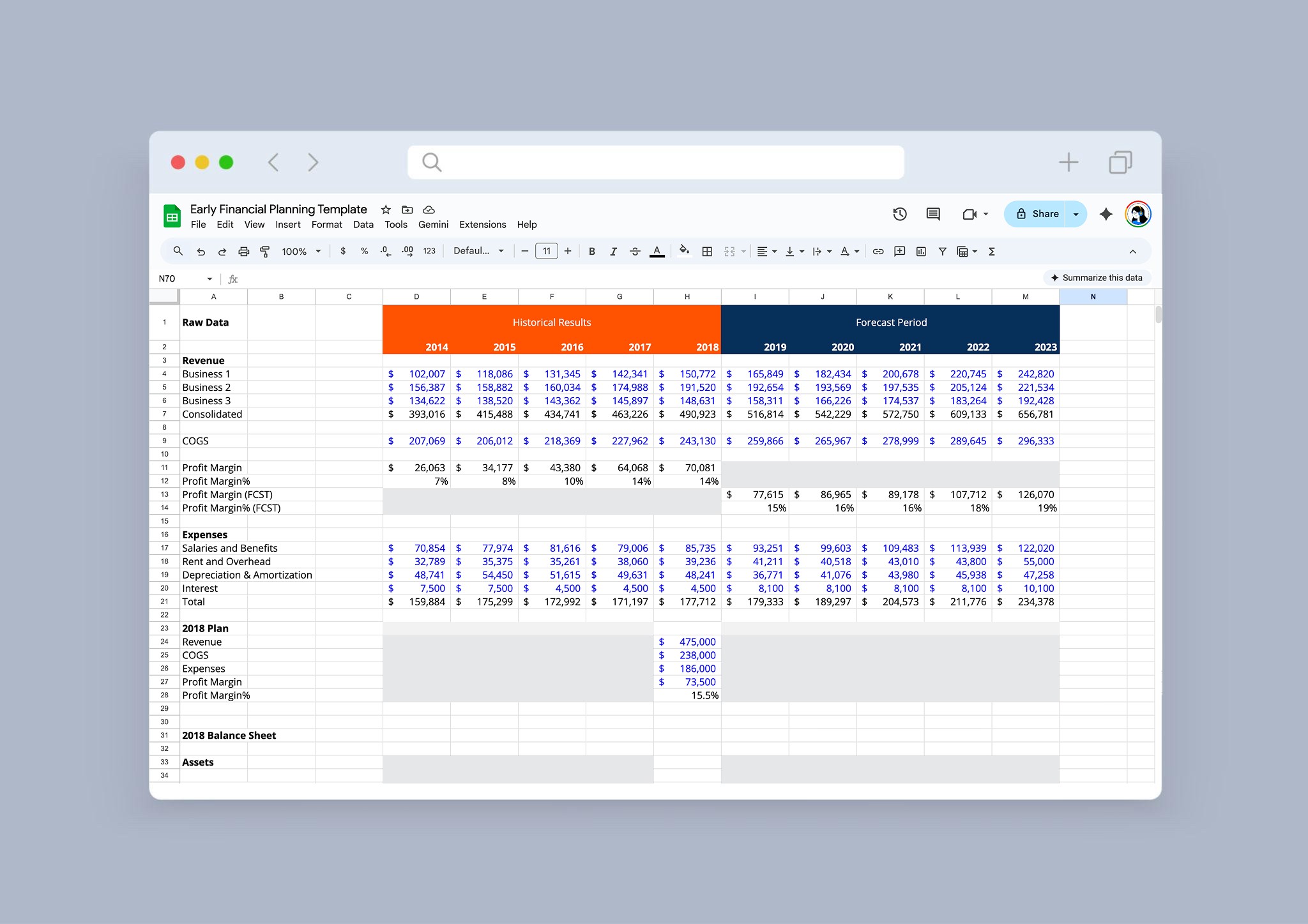

Reduce reliance on spreadsheets and manual analysis

Provide explainable, actionable insights rather than static reports

Support confident decision‑making under uncertainty

The core problem was not data availability, it was decision clarity and trust.

Finmetrx was an early‑stage fintech product with strong backend financial logic and AI experimentation, but no cohesive product experience. Core financial calculations, data pipelines, and agent logic existed in isolation, making the system difficult to use, reason about, and scale.

When I joined, the challenge was not designing "another dashboard", but translating raw financial logic, stakeholder knowledge, and technical constraints into a usable, trustworthy product system.

Primary User & Secondary Roles

Primary User & Secondary Roles

Primary user:

Primary user:

Finance Lead / CFO responsible for forecasting accuracy, cash management, liquidity risk, and financial decision‑making.

Finance Lead / CFO responsible for forecasting accuracy, cash management, liquidity risk, and financial decision‑making.

Secondary user:

Secondary user:

Financial Analysts (deep analysis & validation)

Executives (high‑level consumption of insights)

Operators (inputs and operational context)

Financial Analysts (deep analysis & validation)

Executives (high‑level consumption of insights)

Operators (inputs and operational context)

The product experience was intentionally designed around the CFO’s decision‑making needs, while supporting analysts and executives through role‑appropriate views and permissions.

The product experience was intentionally designed around the CFO’s decision‑making needs, while supporting analysts and executives through role‑appropriate views and permissions.

Discovery & Problem Framing

Discovery & Problem Framing

Discovery was conducted through direct collaboration with company leadership and technical stakeholders.

Discovery inputs included:

Working sessions with founders and finance leadership

Raw financial templates, backend logic, and operational assumptions

Competitive review of FP&A and financial intelligence tools

AI‑assisted synthesis to structure complex financial requirements

Rather than formal UX research artifacts, discovery focused on accurately translating domain knowledge into product structure.

Finmetrx was an early‑stage fintech product with strong backend financial logic and AI experimentation, but no cohesive product experience. Core financial calculations, data pipelines, and agent logic existed in isolation, making the system difficult to use, reason about, and scale.

When I joined, the challenge was not designing "another dashboard", but translating raw financial logic, stakeholder knowledge, and technical constraints into a usable, trustworthy product system.

Product Strategy & Design Principles

Product Strategy & Design Principles

The system was guided by the following principles:

The system was guided by the following principles:

Accuracy over abstraction

finance demands correctness

State‑driven design

clarity through explicit data states

Actual vs Forecast parity

both treated as first‑class

Progressive disclosure

complexity revealed when needed

AI as co‑pilot, not black box

explainable and configurable

Decisions over dashboards

insights tied to actions

Accuracy over abstraction

finance demands correctness

State‑driven design

clarity through explicit data states

Actual vs Forecast parity

both treated as first‑class

Progressive disclosure

complexity revealed when needed

AI as co‑pilot, not black box

explainable and configurable

Decisions over dashboards

insights tied to actions

These principles shaped every design decision across the platform.

These principles shaped every design decision across the platform.

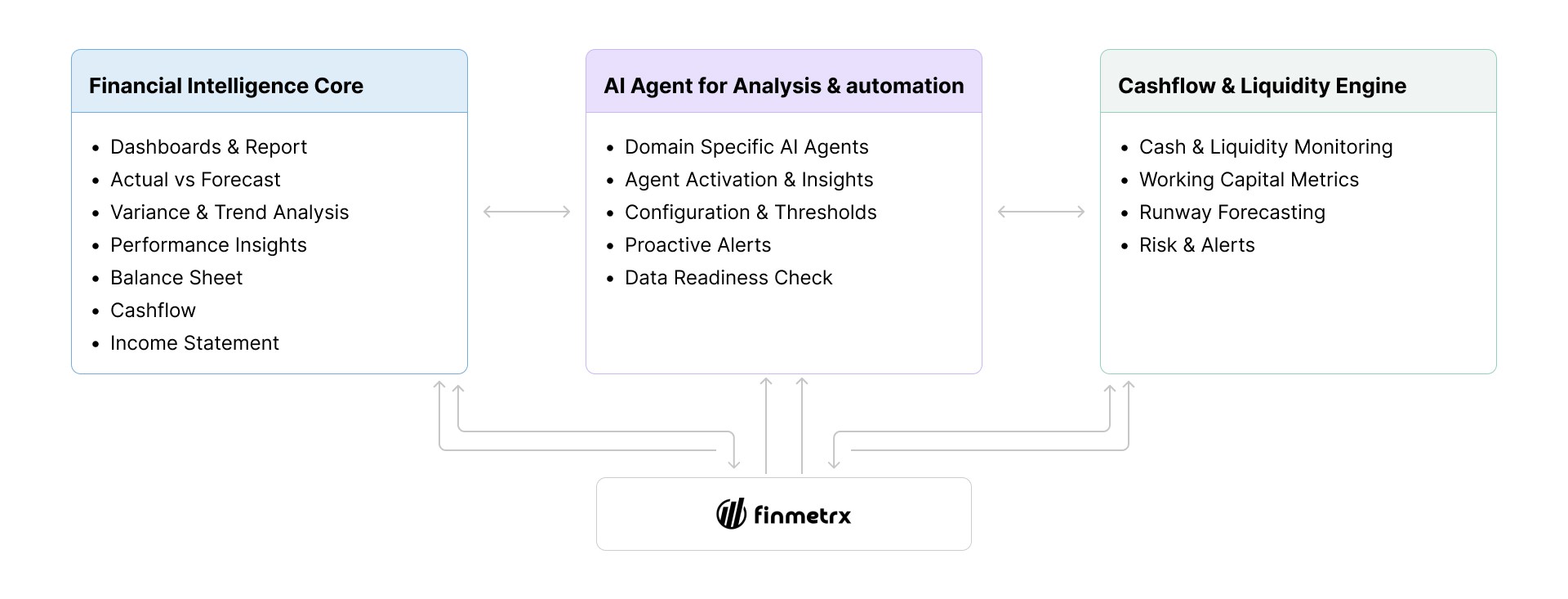

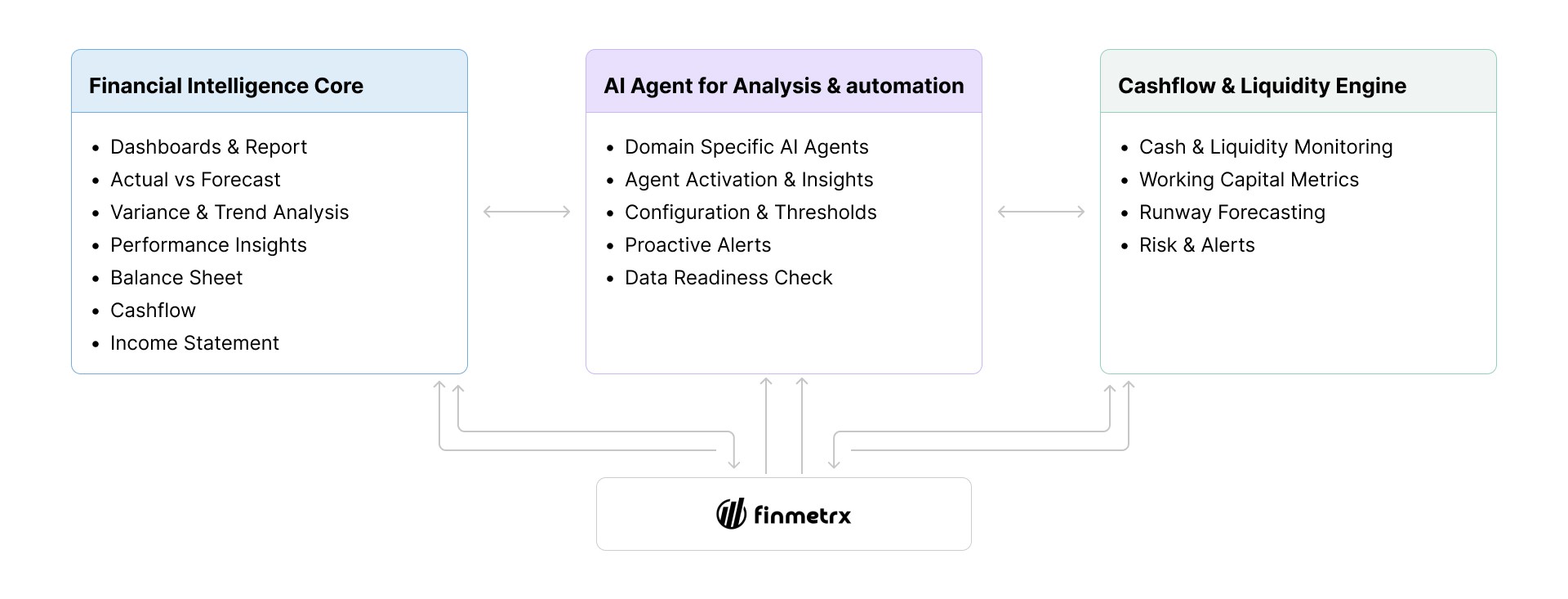

System Architecture (High‑Level)

System Architecture (High‑Level)

Financial Performance & Variance Analysis

Financial Performance & Variance Analysis

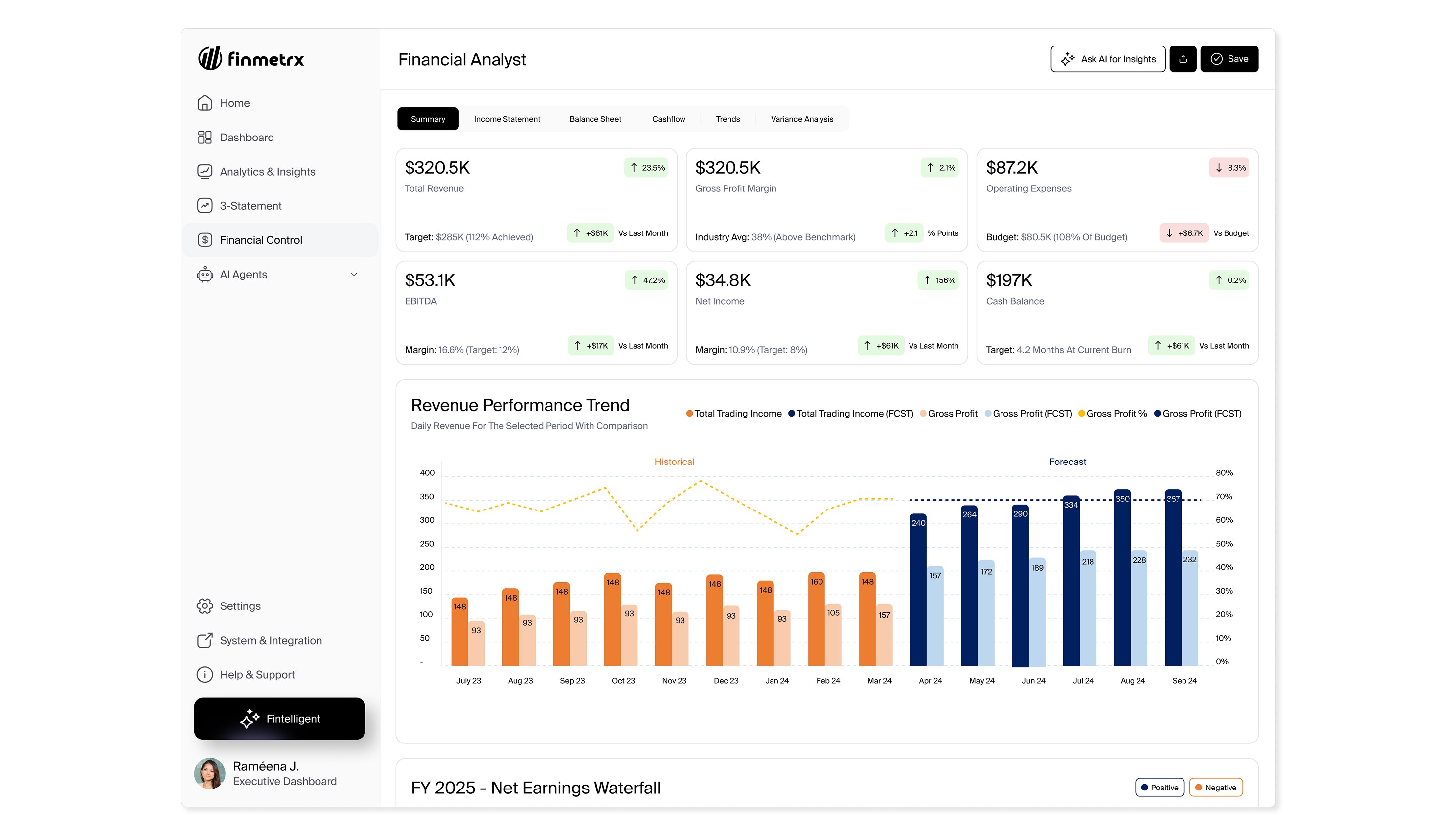

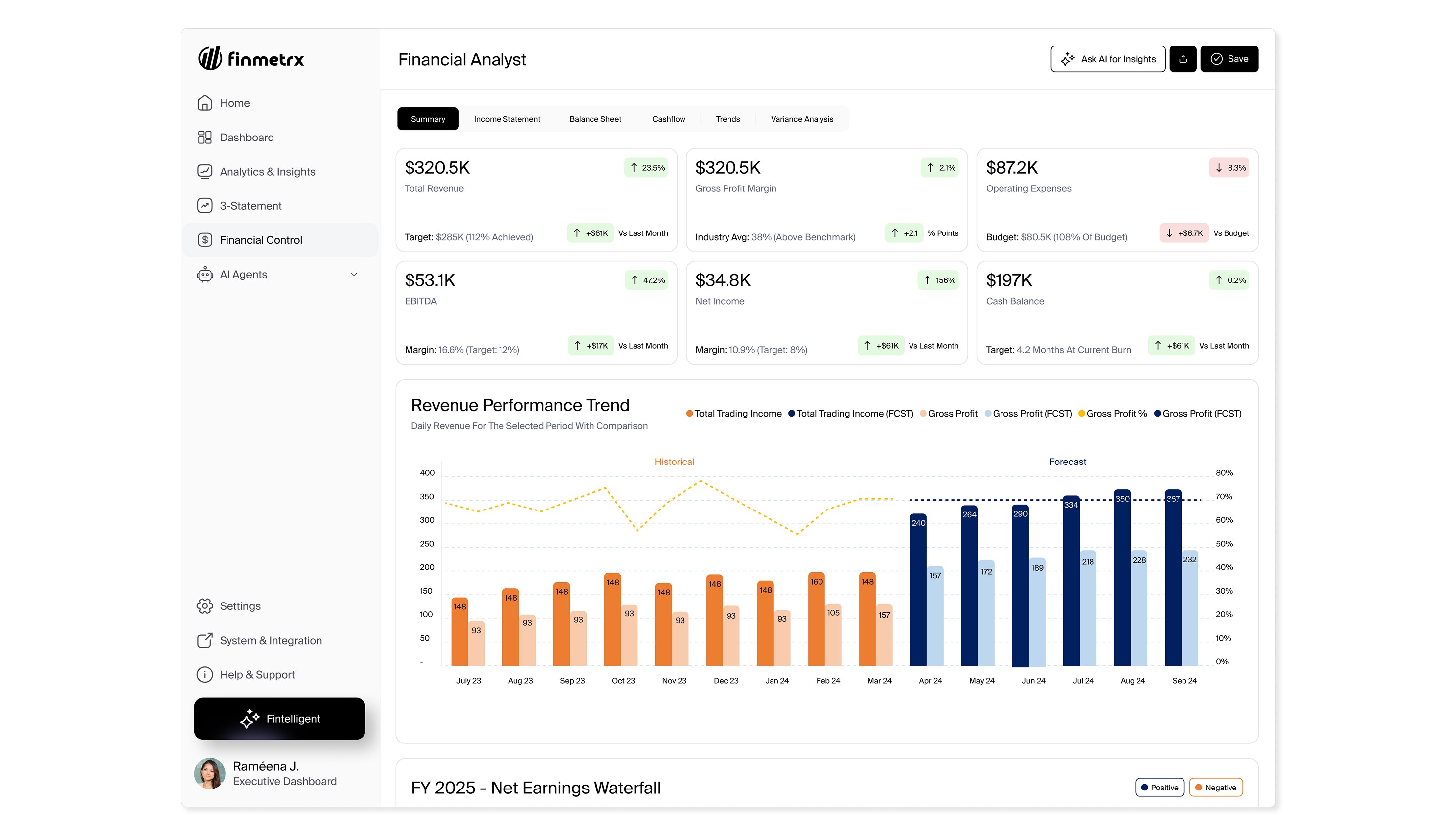

This section shows how finance leaders move from high-level signals to validation and explanation.

Financial Summary

Financial Summary

The financial summary acts as the CFO’s primary entry point, surfacing key performance indicators, targets, and early signals to assess overall financial health at a glance.

The financial summary acts as the CFO’s primary entry point, surfacing key performance indicators, targets, and early signals to assess overall financial health at a glance.

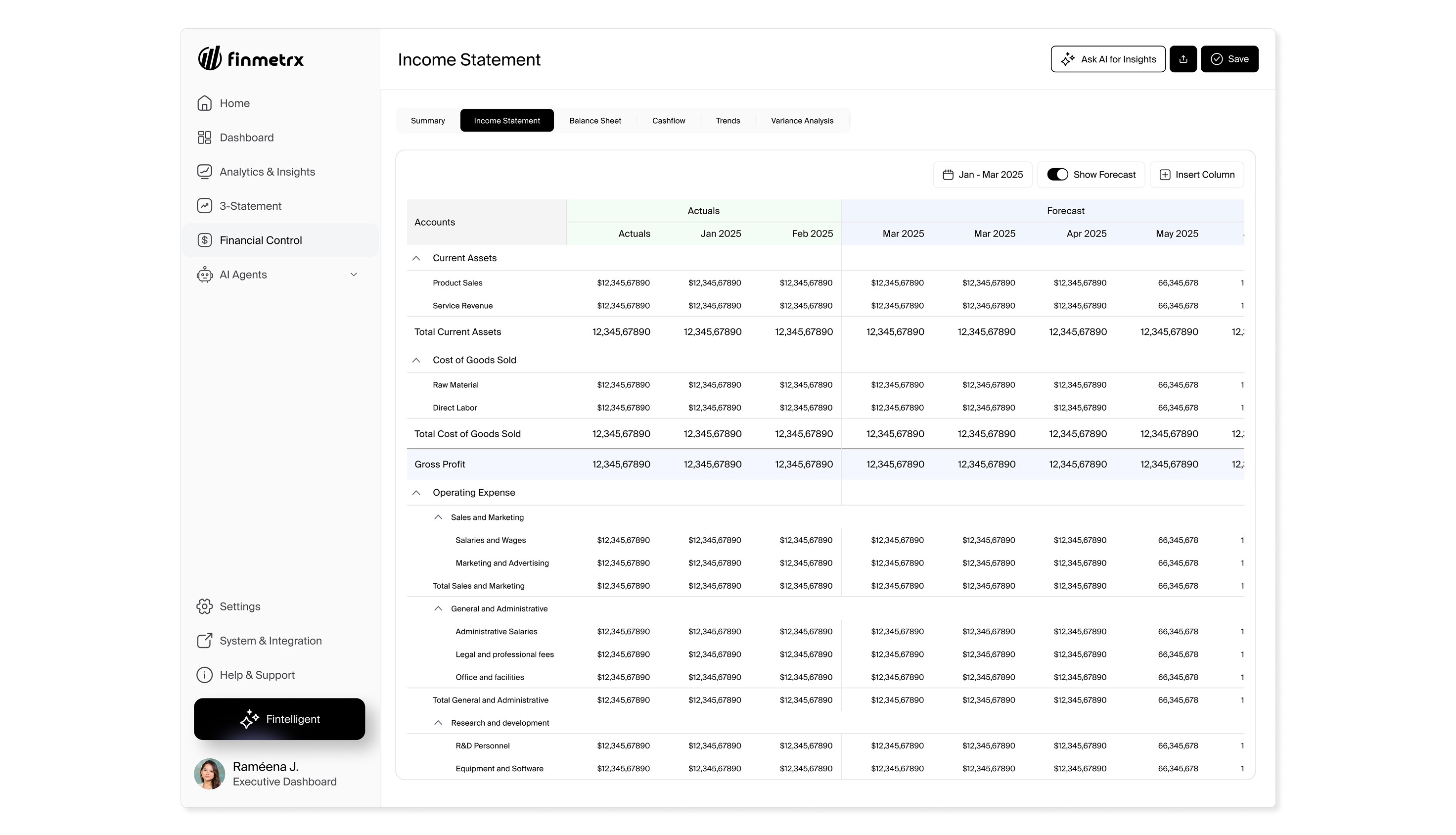

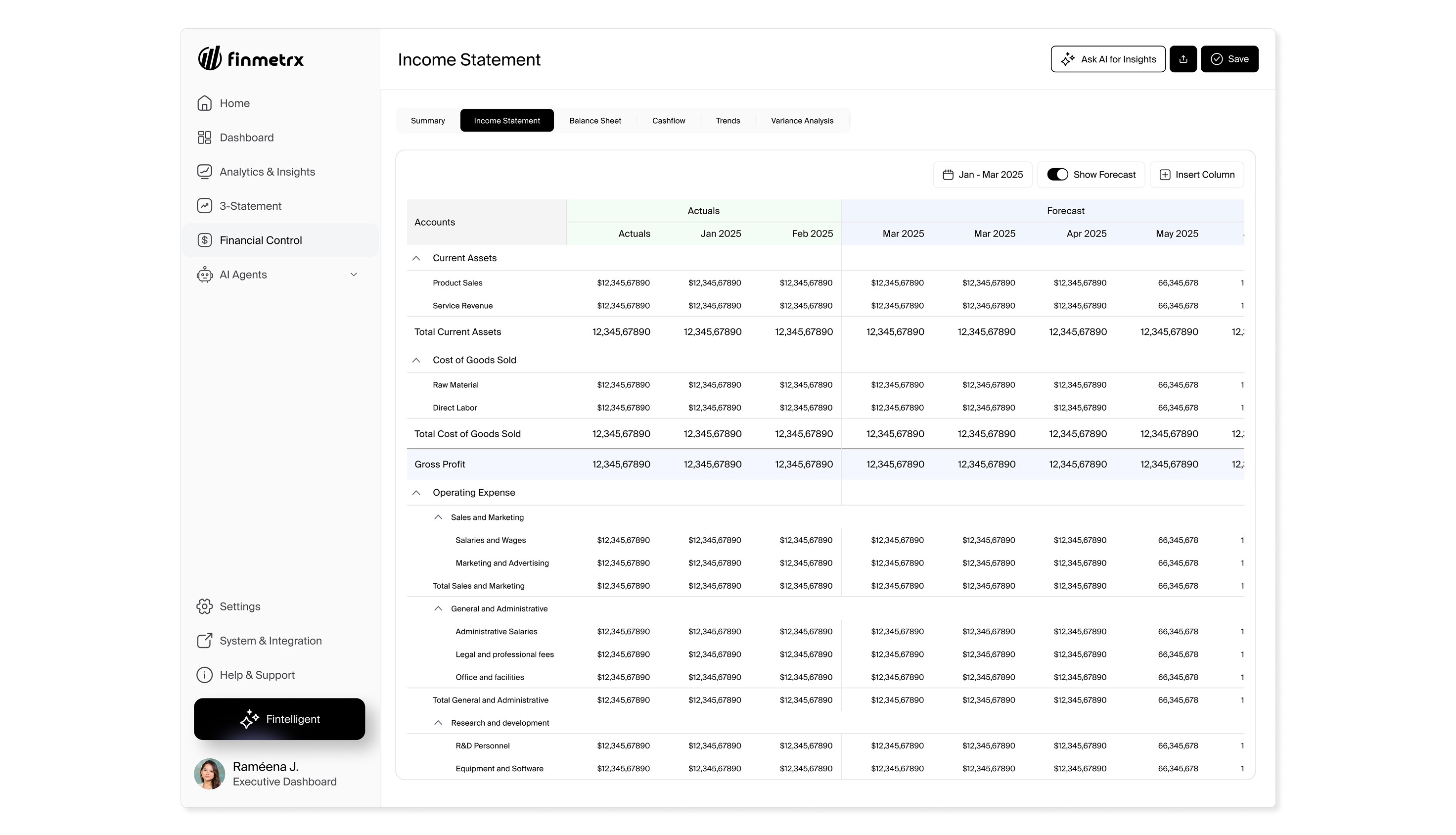

Income Statement, Actual vs Forecast

Income Statement, Actual vs Forecast

The income statement supports detailed validation, allowing finance leaders to reconcile performance with confidence.

The income statement supports detailed validation, allowing finance leaders to reconcile performance with confidence.

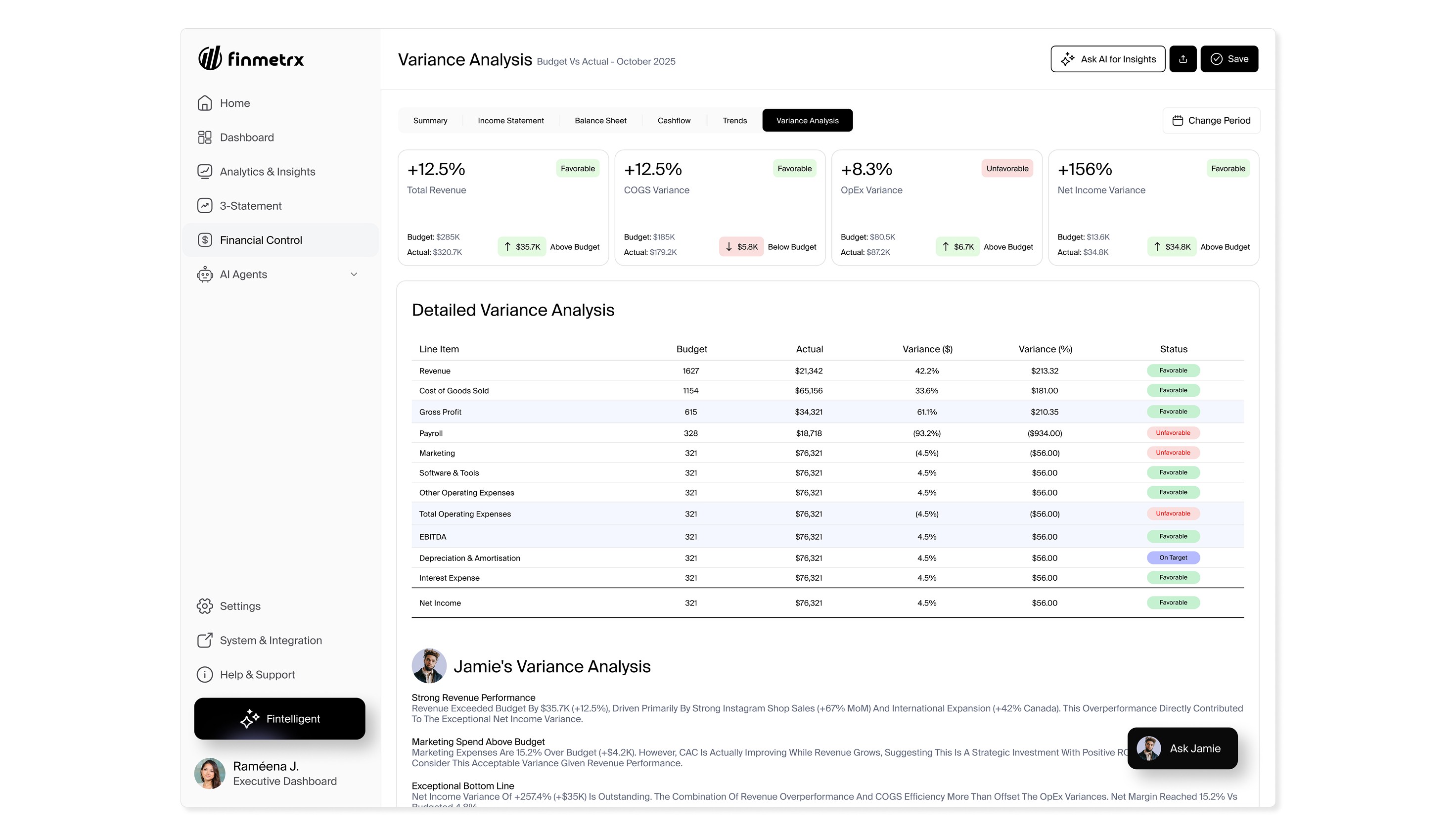

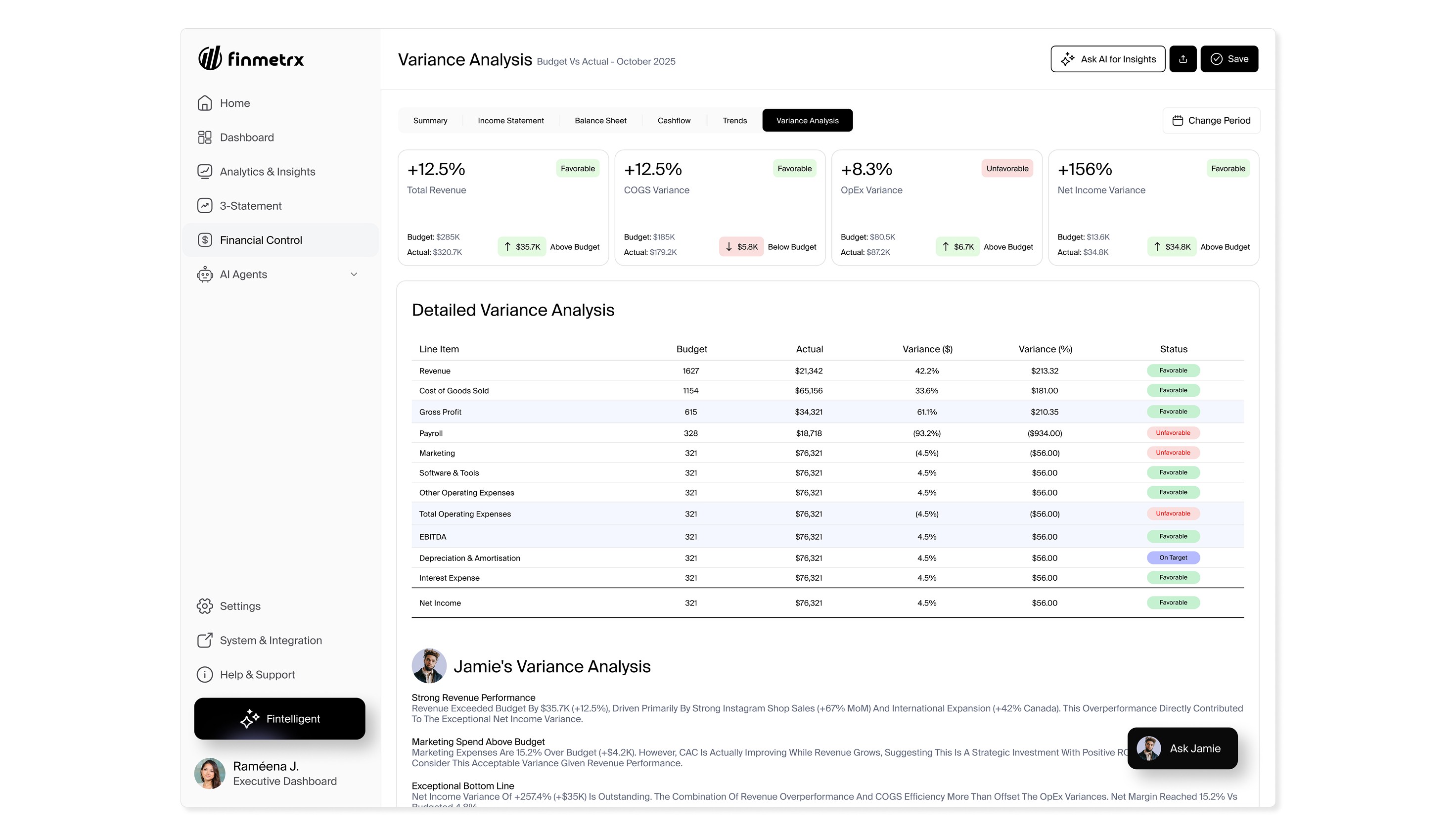

Variance Analysis

Variance Analysis

Variance analysis focuses on explaining deviations rather than simply reporting outcomes, highlighting what changed, why it changed, and where attention is required.

Variance analysis focuses on explaining deviations rather than simply reporting outcomes, highlighting what changed, why it changed, and where attention is required.

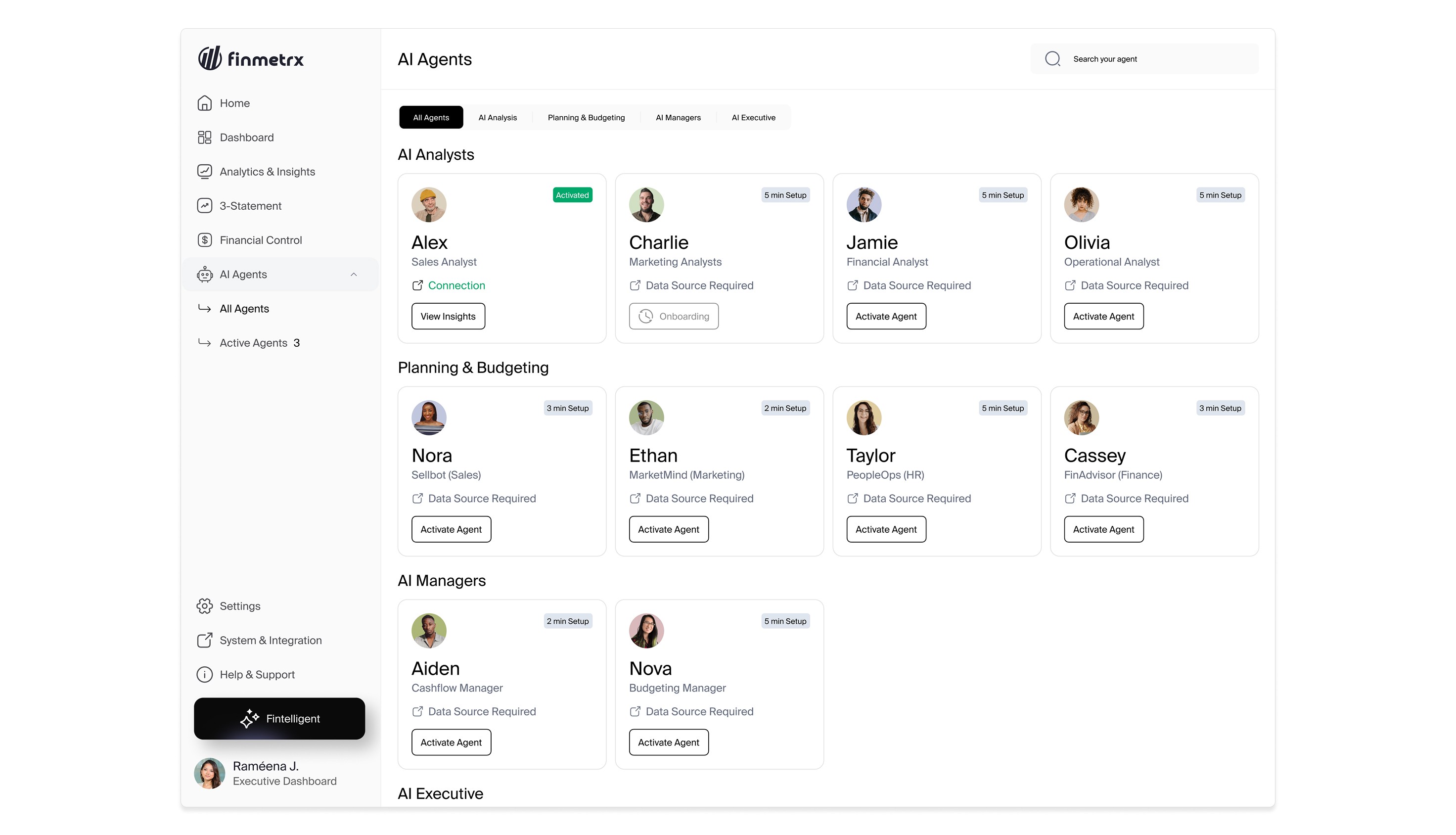

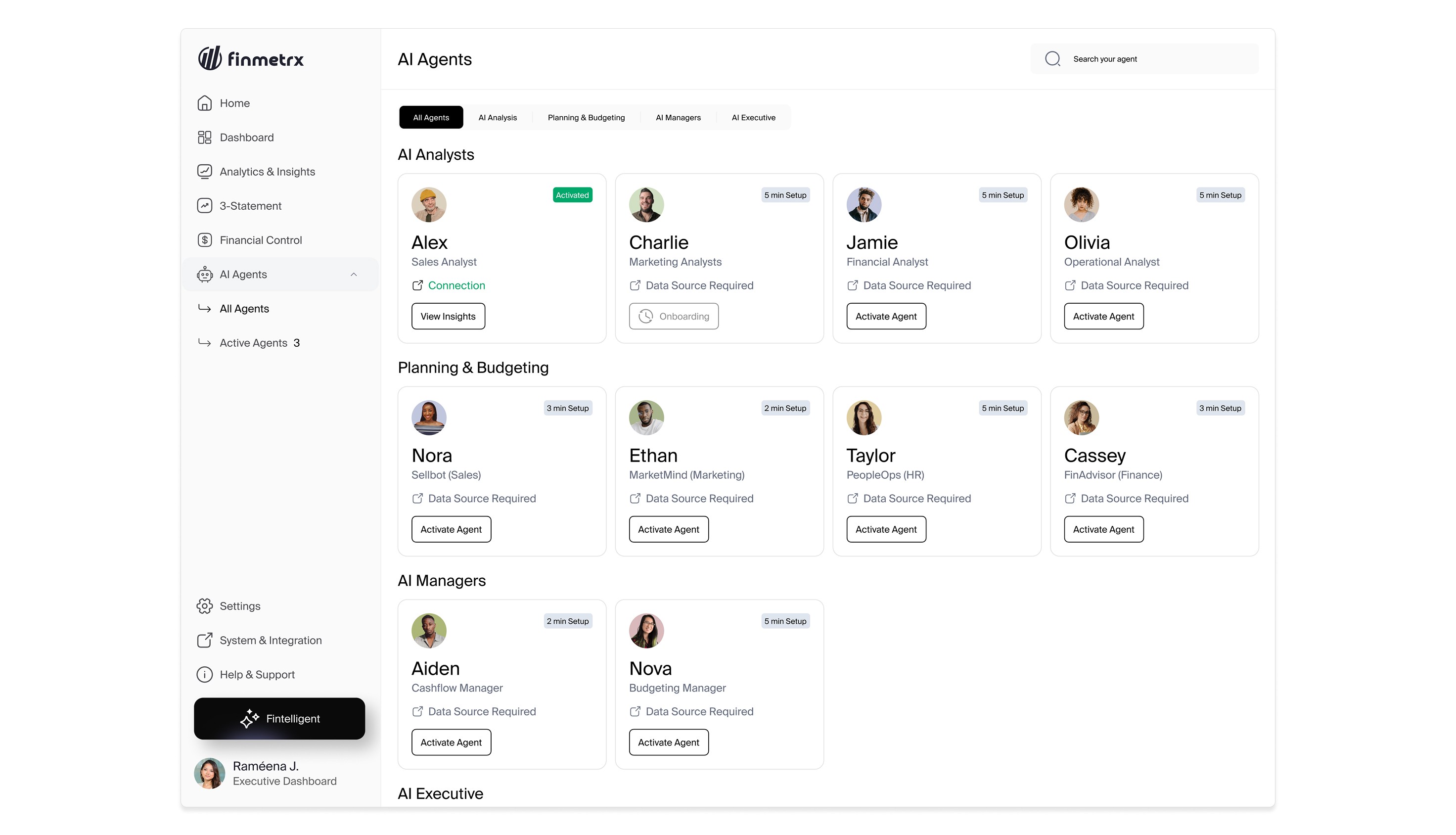

AI Agents, Activation & Configuration

AI Agents, Activation & Configuration

Finmetrx includes domain-specific AI agents designed to assist finance teams with analysis, planning, and monitoring. Agents are intentionally configurable to maintain transparency and trust.

The activation flow ensures agents only operate on complete, high-quality data.

Finmetrx includes domain-specific AI agents designed to assist finance teams with analysis, planning, and monitoring. Agents are intentionally configurable to maintain transparency and trust.

The activation flow ensures agents only operate on complete, high-quality data.

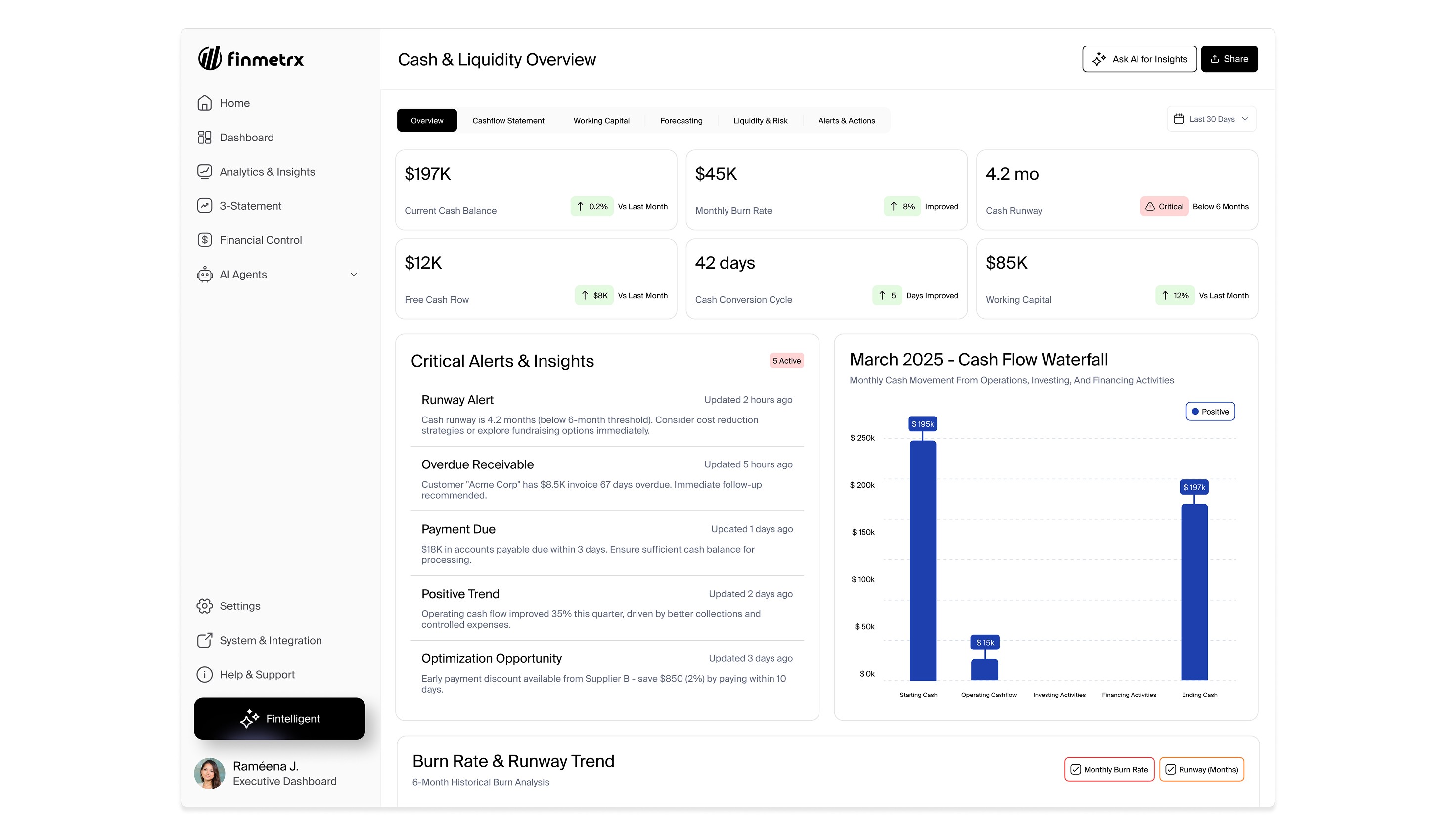

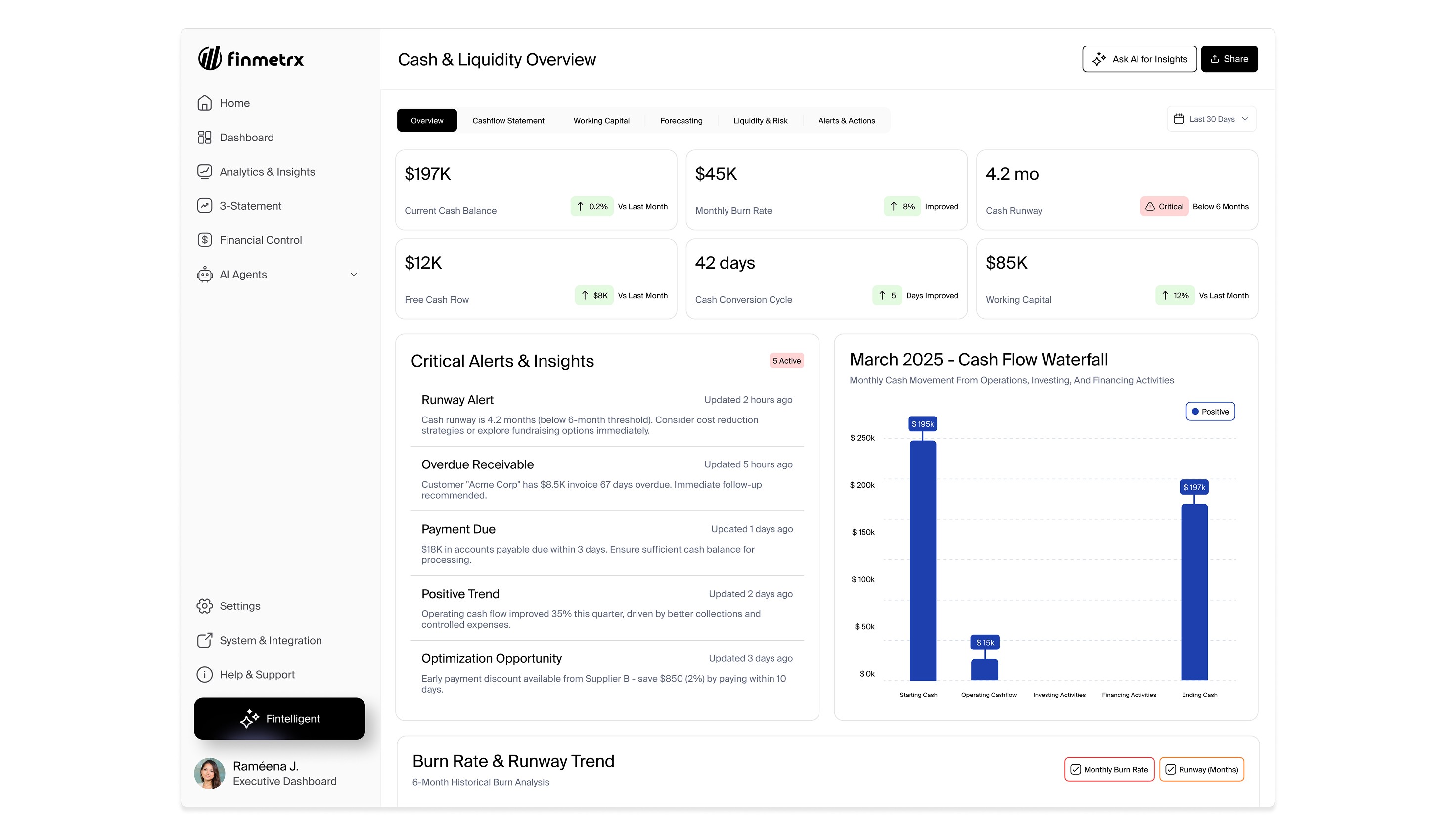

Cash Flow, Liquidity & Risk

Cash Flow, Liquidity & Risk

Cash flow management focuses on proactive visibility into liquidity, runway, and risk rather than retrospective reporting.

Key views surface:

Cash position and runway | Working capital metrics | Forecasted risk scenarios | Alerts and recommended actions

Cash flow management focuses on proactive visibility into liquidity, runway, and risk rather than retrospective reporting.

Key views surface:

Cash position and runway | Working capital metrics | Forecasted risk scenarios | Alerts and recommended actions

Design Decisions & Trade-Offs

Design Decisions & Trade-Offs

Anchored the experience around CFO decision-making rather than analyst workflows

Treated forecasts as first-class data despite added complexity

Required explicit AI configuration to maintain trust

Paired alerts with actions to support timely decisions

Anchored the experience around CFO decision-making rather than analyst workflows

Treated forecasts as first-class data despite added complexity

Required explicit AI configuration to maintain trust

Paired alerts with actions to support timely decisions

Constraints & Realities

Constraints & Realities

High accuracy and accountability requirements

Forecast uncertainty

Integration-dependent workflows

Performance constraints for large datasets

These realities informed conservative, clarity-first design choices.

High accuracy and accountability requirements

Forecast uncertainty

Integration-dependent workflows

Performance constraints for large datasets

These realities informed conservative, clarity-first design choices.

Learnings

Learnings

Financial UX is about reducing ambiguity, not simplifying data

Data quality is a user experience problem

AI systems require explainability to build trust

Clear system behavior matters more than visual complexity

Financial UX is about reducing ambiguity, not simplifying data

Data quality is a user experience problem

AI systems require explainability to build trust

Clear system behavior matters more than visual complexity

Outcome & Impact

Outcome & Impact

Finmetrx established a scalable foundation for financial decision-making by unifying performance analysis, forecasting, AI assistance, and cash flow management into a single product experience.

Finmetrx established a scalable foundation for financial decision-making by unifying performance analysis, forecasting, AI assistance, and cash flow management into a single product experience.

Business Impact

Business Impact

Early market validation: 5 companies onboarded in the first week

Reduced reliance on spreadsheets and manual analysis

Clear value proposition for mid-market finance teams

System Impact

System Impact

Unified financial performance, forecasting, and cash flow workflows

Scalable architecture for AI-driven analysis

User Impact

User Impact

Faster understanding of financial health

Improved confidence in forecasts and decisions

Earlier visibility into cash flow risk

Finmetrx reinforced the importance of designing for trust, accuracy, and real-world financial decisions. Rather than optimizing for visual simplicity, the focus was on building a system finance leaders could rely on under pressure.

Finmetrx reinforced the importance of designing for trust, accuracy, and real-world financial decisions. Rather than optimizing for visual simplicity, the focus was on building a system finance leaders could rely on under pressure.

hello.uxbyray@gmail.com

hello.uxbyray@gmail.com

Some projects are password-protected. If you’d like access or a walkthrough, feel free to contact me via email.

Some projects are password-protected. If you’d like access or a walkthrough, feel free to contact me via email.